Digital wallet usage surges in South Africa, Stitch reports

Postado por Editorial em 22/07/2025 em TECH NEWSAs adoption of Apple, Google and Samsung Pay rises in South Africa, we take a step back to examine what's led us here, and how businesses can benefit.

Adoption of digital wallets such as Apple Pay, Google Pay, and Samsung Pay has increased significantly in South Africa, according to the latest Consumer Payments Report by payments infrastructure company Stitch. The research shows that more than 70% of consumers in the country have used digital wallets for daily payments, representing a major leap from last year's results, when 46% said they had never used these payment methods.

As access to online payments via Apple Pay, Google Pay and Samsung Pay expands, Stitch reports growing consumer interest and swift adoption in regions where these wallets are available for e-commerce.

South Africa Is Ripe for Digital Wallet Growth

South Africa’s high rates of mobile and banking penetration create ideal conditions for digital wallet adoption. The country’s 2022 national census revealed that over 92% of households own a mobile phone, with more than 60% accessing the internet through mobile. At the same time, more than 85% of households have access to a bank account.

Still, it’s important to distinguish between contactless card payments—which are already widely used—and digital wallets, which are gaining traction.

Digital Wallets vs. Contactless Cards

While both technologies rely on near-field communication (NFC), they differ in their use cases. Contactless card payments require a physical card and are limited to in-person purchases. In contrast, digital wallets allow users to make payments both online and in-store, using tokenised data and device-level authentication such as biometrics or PIN.

With digital wallets, users store card credentials in an app, which protects sensitive data and enables quick, secure transactions—often without requiring an internet connection.

How Digital Wallets Work for Online Payments

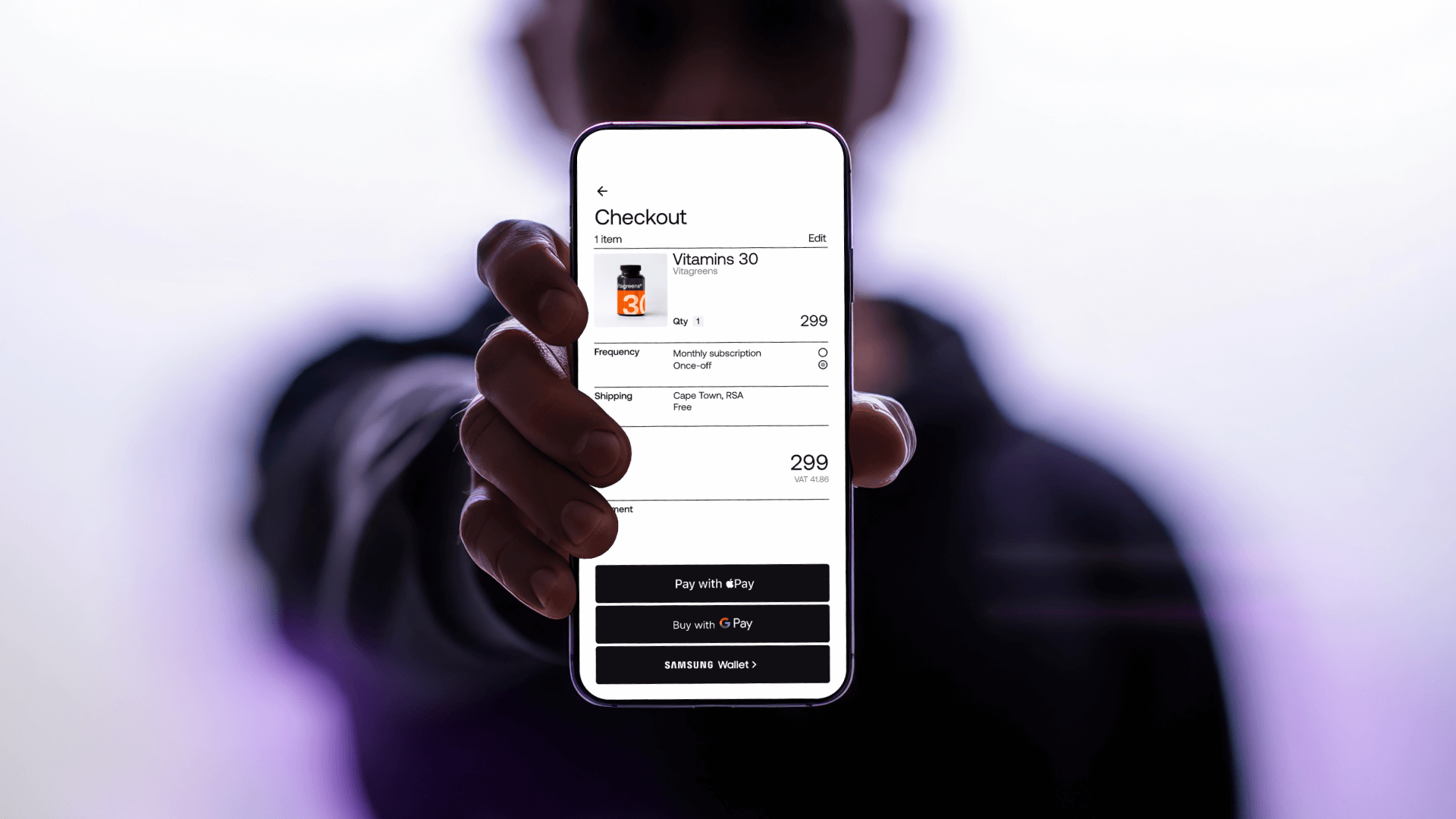

In online transactions, a user selects a digital wallet option (Apple Pay, Google Pay or Samsung Pay) at checkout. Depending on the device, the wallet option may be surfaced automatically through PSPs like Stitch. Once authenticated, tokenised card data and a dynamic cryptogram are sent through the card network to the issuing bank, where the transaction is authorised or declined.

This simplified process eliminates the need to input card details or complete a 3DS flow, enhancing speed and reducing friction. According to Stitch, merchants also benefit from lower interchange fees, reduced chargebacks and stronger fraud protection.

Why Adoption Is Growing

Adoption of digital wallets in South Africa continues to accelerate. Stitch’s report highlights that banks like FNB have seen digital wallet volumes rise by 74% between 2023 and 2024.

Digital wallets offer convenience, security and better user experience for both consumers and merchants. As NFC-enabled smartphones become more accessible, wallets like Apple Pay, Google Pay and Samsung Pay are easier to use and increasingly preferred.

Unlike physical cards, these wallets rely on biometric authentication and don’t require users to remember PINs. For online payments, there’s no need to enter card details, which speeds up checkout and boosts conversion rates.

Enhanced Security and Lower Fraud Risk

The Stitch report also points to digital wallets’ impact on reducing card-not-present fraud—an area that accounted for 68% of card fraud losses in 2023. By using tokenisation and biometric verification, digital wallets provide stronger security without compromising user experience.

Higher Conversion Rates with Apple Pay

Apple Pay, in particular, has shown impressive performance in e-commerce. Stitch reports that conversion rates for Apple Pay are 42% higher than for traditional card payments. On a major e-commerce site, over 33% of iOS users adopted Apple Pay within the first week of its launch. Notably, 50% of Apple Pay transactions are completed in under 3 seconds, and 95% within 5.2 seconds.

South African Consumers Are Ready

According to the Stitch report, 23% of South African consumers use digital wallets frequently or always. For merchants, this represents a clear opportunity to meet consumer demand, reduce friction at checkout, and ultimately increase revenue.