EasyEquities streamlines real-time investing with instant payments powered by Stitch

Postado por Editorial em 14/01/2026 em MARKET & INDUSTRYPartnership removes funding delays and helps turn fast-moving market opportunities into accessible investing for South Africans.

When EasyEquities entered the South African market, its ambition was clear: make investing accessible to people who had long been excluded by high fees, complex platforms and rigid financial infrastructure. At the time, retail participation in the stock market was limited to a small segment of the population, with roughly 280,000 individual stockbroking accounts nationwide. EasyEquities set out to change that by removing traditional barriers through features such as fractional share ownership and a simplified, intuitive user experience.

As the platform gained traction and helped drive growth in retail investing from 2021 onwards, another challenge became increasingly apparent. While the front end of investing had been simplified, moving money in and out of accounts still relied on traditional banking rails that were not designed for speed or immediacy. For a platform built around accessibility and real-time decision-making, funding delays risked becoming a bottleneck.

In investing, timing often determines outcomes. Market movements can be sudden, and opportunities may disappear within minutes. EasyEquities needed a way for users to fund their accounts instantly and withdraw their money just as quickly, without friction or uncertainty. The company began looking for a payments partner that could match its product philosophy while navigating the realities of the South African fintech environment.

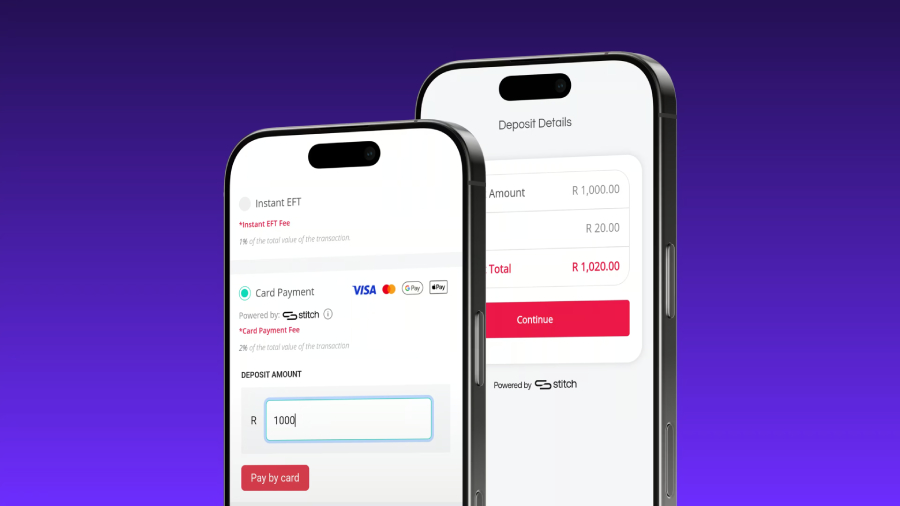

That search led to a partnership with Stitch in 2023. By integrating Stitch’s payments infrastructure, EasyEquities introduced instant account funding, initially through Pay by bank, and later expanded to include modern payment options such as Apple Pay, Samsung Pay and Google Pay. The same technology was then applied to the other side of the transaction, enabling instant withdrawals around the clock, including for proceeds from international trades.

For EasyEquities, the impact was immediate. Investors gained the ability to move money into their accounts in real time, allowing them to respond quickly to market opportunities. Withdrawals, which are often a point of frustration for users, became available 24 hours a day, seven days a week, providing greater confidence and control over their funds. Behind the scenes, the payments flow became more reliable and less dependent on manual processes, reducing friction across the entire user journey.

“Stitch plays a core role in enabling best-in-class investing,” said Almero Oosthuizen, Chief Product Owner at EasyEquities. “They solve a critical part of the journey by making it easy to bring money onto the platform, and they also enable the last step – getting money out – in a way that’s fast and dependable.”

The improvements in payment speed and reliability translated directly into a better overall experience for users. According to the EasyEquities team, reduced delays and fewer points of failure led to higher engagement and growing satisfaction among investors who now expect digital financial services to work in real time.

“It’s very important for us to make the experience as seamless as possible,” said Don Kruger, Head of Platform at EasyEquities. “Stitch is a key part of making that experience easy, secure and intuitive for our customers.”

Beyond the technology itself, EasyEquities points to the collaborative nature of the partnership as an important factor. Stitch’s understanding of the local market and willingness to work closely with the team helped ensure the payments layer evolved alongside the platform’s broader product roadmap.

Looking ahead, EasyEquities continues to invest in expanding access to investing for South Africans. The company is building on its early innovations, such as fractional share ownership, while adding new asset classes and increasing access to international markets. At the same time, it is exploring the use of more advanced technologies, including artificial intelligence, to make investing not only easier, but also more informed.

As EasyEquities scales its offering, the ability to move money instantly and reliably remains a foundational requirement. By removing friction from the funding process, the partnership with Stitch has helped turn real-time investing from an aspiration into a practical reality for a growing base of retail investors across South Africa.