Onafriq partners with Visa to drive digital financial inclusion in the DRC

Postado por Editorial em 18/09/2025 em TECH NEWSThe collaboration introduces Visa Pay, a cloud-native platform that links mobile money wallets with Visa’s global network, expanding access to everyday digital payments in one of Africa’s fastest-growing financial markets.

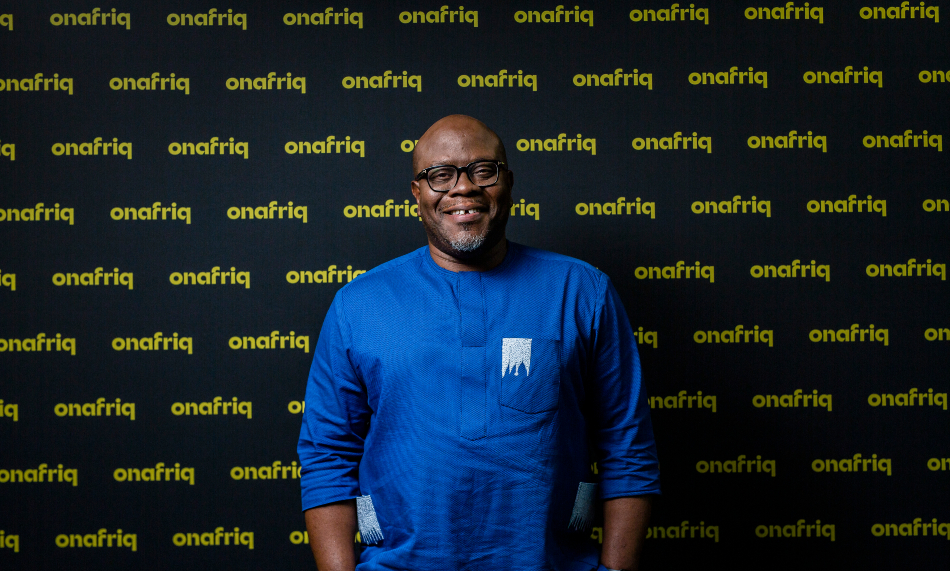

Onafriq’s founder and CEO, Dare Okoudjou

Onafriq, Africa’s largest digital payments network, has entered into a strategic partnership with Visa to launch Visa Pay in the Democratic Republic of Congo (DRC). The initiative is designed to accelerate financial inclusion by making digital and e-commerce transactions more accessible to millions of consumers.

Through the collaboration, users in the DRC will be able to fund their Visa Pay wallets directly from mobile money services such as M-Pesa, Airtel Money and Orange Money. Powered by Onafriq’s APIs, the solution bridges Visa’s global card network with the country’s existing mobile money ecosystem, delivering seamless interoperability and expanding payment options for both individuals and businesses.

“This partnership reflects our ambition to accelerate financial inclusion in the DRC,” said Sophie Kafuti, Visa’s General Manager for the country. “By linking Visa Pay to mobile money, we are creating the interoperability foundation needed to boost digital commerce adoption nationwide.”

The launch comes as the mobile payments industry in the DRC experiences rapid growth. According to GSMA, the sector is expected to reach $3.85 billion in transaction value this year, growing at a compound annual rate of 19%. The market spans retail payments, e-commerce, government services, bill settlements, payroll, and business collections.

Christian Bwakira, Chief Commercial Officer at Onafriq, emphasized the broader impact: “For years, Onafriq has been connecting Congolese consumers to Africa and the world as a trusted infrastructure provider. This partnership shows the power of combining Visa’s global scale with our strong local presence to create transformative opportunities for innovation and inclusion.”

Looking ahead, the partnership could serve as a launchpad for Visa Pay’s expansion into additional African markets, where mobile money adoption is already widespread and demand for interoperable, digital-first payment solutions continues to grow.