Technology infrastructure drives financial inclusion across South Africa's informal economy

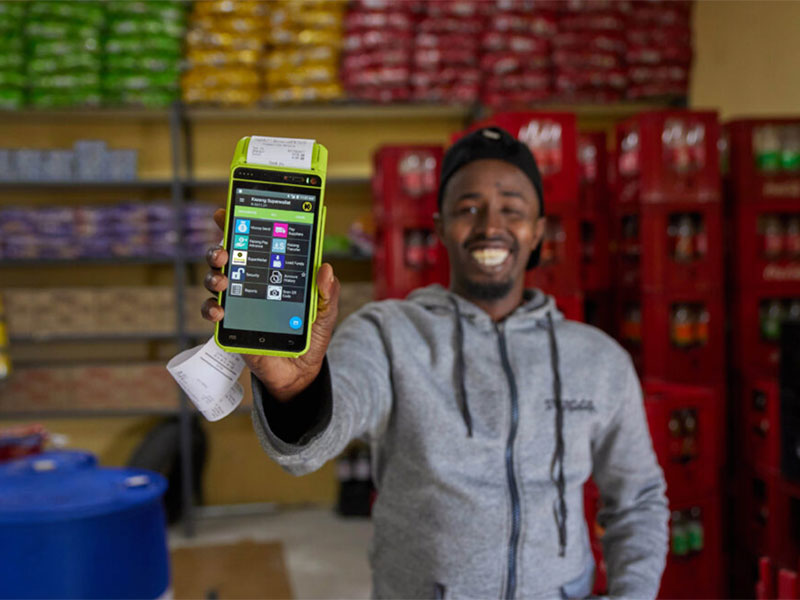

Postado por Editorial em 20/10/2025 em MARKET & INDUSTRYKazang's digital payment platform enables 50,000+ informal traders to modernize operations, bridging the gap between traditional commerce and digital financial services

Digital infrastructure is reshaping South Africa's informal trading sector, transforming how merchants operate and serve customers in townships, peri-urban areas, and rural communities. Since COVID-19 lockdowns accelerated adoption of digital payments, technology platforms have become the foundation enabling small-scale traders to compete and grow in an increasingly connected economy.

Kazang, the prepaid value-added services and card acquiring division of JSE-listed fintech Lesaka Technologies, has positioned technology as the cornerstone of merchant empowerment in this segment. The company's integrated platform demonstrates how layered digital services, rather than single-point solutions, create sustainable transformation in underserved markets.

"Merchant enablement through technology is the catalyst for improving access to financial services within the informal market," explains Martin Wright, CEO of Kazang. "The picture has changed significantly over the past few years as traders recognize digital tools as business accelerators, not barriers."

This recognition stems from Kazang's approach of building technology as infrastructure rather than add-on. The company's platform enables approximately 90,000 merchants to offer value-added services including prepaid electricity, airtime and data, television subscriptions, bill payments, and gaming vouchers. This breadth of services running on unified technology architecture allows merchants to become community service hubs rather than simple retailers.

Over the past four years, that architectural foundation enabled Kazang to deploy its Kazang Pay card acquiring solution to more than 50,000 informal traders, allowing them to accept card payments and offer point-of-sale withdrawals. The technology handles both sides of the transaction equation: customer payments coming in and supplier payments going out. Since launching approximately 2.5 years ago, the platform has processed growing volumes of card transactions, predominantly debit cards, scaling monthly transaction values from zero to over R1 billion.

The velocity of that growth demonstrates how technology adoption accelerates once infrastructure proves reliable and economically viable. Card transactions settle instantly into digital merchant wallets, where funds become immediately available for supplier payments. This architecture eliminates traditional pain points: merchants can pay approximately 600 FMCG suppliers directly from the device, reducing cash handling risks and accelerating working capital cycles.

The economic model itself removes barriers to adoption. Kazang provides terminal hardware at no cost to merchants meeting modest monthly transaction thresholds, eliminating capital requirements that typically block digital adoption in informal markets. Low acceptance fees further reduce friction, allowing even small-volume merchants to benefit from digital infrastructure without eroding already-thin margins.

"Our differentiator lies in platform breadth," Wright notes. "The technology enables card acceptance and supplier payment solutions that streamline transactions, while simultaneously allowing merchants to offer complete value-added services to their customers. With over 50,000 point-of-sale devices functioning as ATMs, we've effectively embedded banking infrastructure into neighborhood stores."

This distributed ATM network addresses a fundamental infrastructure gap that formal banking has struggled to fill. Consumers can withdraw cash, purchase data for job searches or children's education, pay utility bills, and access lottery services without traveling to formal banking centers. Technology collapses distance barriers that have historically limited financial access in underserved areas, turning corner shops into full-service financial touchpoints.

Building on this foundation, Kazang recently launched a rewards platform directly on its devices, demonstrating how technology infrastructure can layer additional value over time. The platform connects suppliers and product partners to the merchant base through the handheld device, enabling targeted rewards, incentives, surveys, and promotions based on merchant behavior. Since launching February 1st, over one-third of Kazang's merchant network has activated rewards functionality, claiming 30,000 offers. This engagement rate illustrates how merchants view the technology as comprehensive business tool rather than simple payment terminal.

The strategic value of that engagement became clearer in March when Lesaka expanded its technology footprint through acquiring Touchsides, a data analytics and merchant services company previously owned by Heineken International. The acquisition extends Kazang's presence in South Africa's tavern industry while creating potential for data monetization, converting transaction patterns and merchant insights into actionable business intelligence that benefits both merchants and their suppliers.

These developments reveal broader principles about digital transformation in emerging markets. Technology becomes transformative when it addresses specific operational challenges rather than simply digitizing existing processes. For Kazang's merchants, the platform solves working capital constraints, reduces cash security risks, expands service offerings, and creates new revenue streams, all through integrated digital infrastructure that merchants access through a single device.

"Digitalizing the informal economy enhances financial inclusion and grows microbusinesses across southern Africa," Wright emphasizes. "We're helping small merchants serve customers better and provide easier access to essential services. Creating prosperity in this market segment by solving merchants' pain points through technology catalyzes broader economic growth."

The trajectory suggests informal market digitalization is less about forcing technology adoption and more about building infrastructure that makes digital tools the obvious business choice. When technology reduces costs, accelerates cash flow, expands services, and creates growth opportunities, adoption follows naturally. Individual merchant adoption aggregates into network effects: more acceptance locations drive consumer behavior change, which incentivizes additional merchants to join, creating self-reinforcing growth cycles powered by underlying technology infrastructure.

What began as a response to COVID-19 necessity has evolved into permanent transformation, with technology serving as the foundation that allows South Africa's informal economy to participate fully in the country's digital future.